Balancing Act: Navigating the S&P 500's Uneven Dividend Landscape

March 21, 2025 | See how S&P 500 dividend payouts vary by sector, plus updates on Nike earnings, J.M. Smucker’s dividend, and PepsiCo’s Poppi deal.

The S&P 500 index is full of dividend payers. I examine the sector breakdown of these stocks and how the payouts are impacted by the S&P 500’s market-capitalization weighting. Then, I move on to Nike Inc.’s (NKE) earnings, take a fresh look at J.M. Smucker Co. (SJM) and raise a can to PepsiCo Inc.’s (PEP) latest acquisition.

Here are the deets:

Dividends can be found across the S&P 500 sectors, but the payout contributions are lopsided. The Dividend Investing (DI) model portfolio avoids this by using a quasi-equal-weight strategy.

Nike started out the model portfolio’s first-quarter 2025 earnings season with a beat, but its new CEO’s overhaul has led to disappointing guidance.

J.M. Smucker gets a Dividend Valuation Grade of B for its 4.0% yield, though dividend growth has slowed following the acquisition of Hostess Brands Inc. in 2023.

PepsiCo announced its intent to acquire prebiotic soda company Poppi, giving it immediate entry into the fastest-growing segment of the soft drink market.

More than 80% of the companies within the S&P 500 pay dividends. This makes it easy for dividend-seeking investors to build portfolios that are diversified across sectors and industries.

Diversification is done intentionally in the DI model portfolio. As I mentioned last week, the DI approach purposely passed on adding Merck & Co. Inc. (MRK) because it would have increased the portfolio’s exposure to health care stocks. There is nothing wrong with the sector; the DI approach just avoids putting all of its eggs in a single basket.

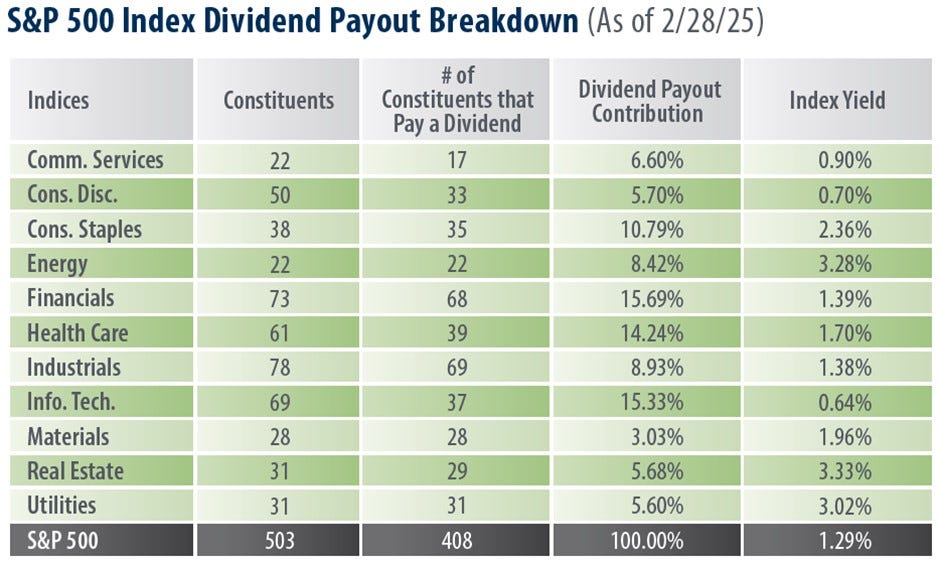

The table below from First Trust Portfolios shows the differences in dividend payout contributions among S&P 500 sectors. This is due to the index being market-cap weighted. The information technology sector has the lowest yield but accounts for the largest contribution because it contains some of the largest companies by market cap.

Source: First Trust Portfolios, with data from S&P Dow Jones Indices.

The DI model portfolio, conversely, follows a quasi-equal-weight strategy. It seeks to establish new positions in the portfolio at a size equal to the average portfolio value of all stocks. The math is simply the total value of the portfolio divided by 24 stocks. This prevents any single stock from having an outsized impact on performance or the portfolio’s income.

Rather than rebalance the portfolio at preset intervals, the DI approach gives its winners room to run. If one stock should do well enough to account for an outsized position in the portfolio—meaning two times the average size (approximately 8.2% of the total portfolio value)—it will be trimmed. The approach also reinvests excess funds in underweight positions when there is enough cash to do so. (The portfolio is paper traded, but it is tracked as if it were a real portfolio.) This avoids the lopsidedness you see with the S&P 500.

A Few Dividend Statistics of Interest

Here are a few notes from First Trust Portfolios about what is occurring dividend-wise within the S&P 500:

Dividend payments from the S&P 500’s constituents totaled a record $74.61 per share in 2024, up from $70.91 per share (previous record high) in 2023.

As of March 12, 2025, dividend payments are estimated to increase to $81.65 and $86.64 per share in 2025 and 2026, respectively.

The index’s dividend payout ratio was 35.57% on March 12. A dividend payout ratio between 30% and 60% is typically a good sign that a dividend distribution is sustainable, according to Nasdaq.

Nike Beats but Gives Disappointing Guidance

Nike handedly beat the S&P Global consensus estimate with earnings of $0.54 per share for its fiscal third-quarter 2025 ended February 28. Gross margin declined 3.3 percentage points as the company sought to clear out inventory. CFO Matt Friend guided for fiscal fourth-quarter 2025 revenues to be down “in the mid-teens [percentage] range, albeit at the low end” and for gross margins to be down “four to five percentage points.”

Though the guidance is disappointing, it is not unusual for a company that is in the process of altering its strategy. It will take time to tell if CEO Elliott Hill is making the right decisions.

An Updated Look at J.M. Smucker

It has been many months since we took an updated look at J.M. Smucker, so I am featuring the stock this week.

J.M. Smucker is a packaged food company. It is the biggest branded at-home coffee manufacturer, with Folgers, Café Bustelo and Dunkin’ among its brands. Retail coffee, as the segment is called, accounts for 34% of J.M. Smucker’s year-to-date fiscal 2025 net sales. (J.M. Smucker’s fiscal year runs from May through April.)

Frozen handheld and spreads accounted for nearly 22% of sales. This segment includes J.M. Smucker’s very popular Uncrustables sandwiches and Jif peanut butter. Pet foods—including Milk-Bone and Meow Mix—account for 19% of sales. Hostess and the sweet baked snacks category account for 14% of sales.

Fiscal third-quarter 2025 sales fell slightly from the prior-year quarter. The company blamed the decline on supply chain disruptions in the pet food segment. Adjusted earnings, however, were above the S&P Global consensus estimate. J.M. Smucker raised its fiscal-year 2025 earnings guidance by 1% last month.

The company has paid a dividend since 1960. J.M. Smucker has raised its dividend for 22 consecutive years. We will be looking for the next dividend increase to be announced in mid-July.

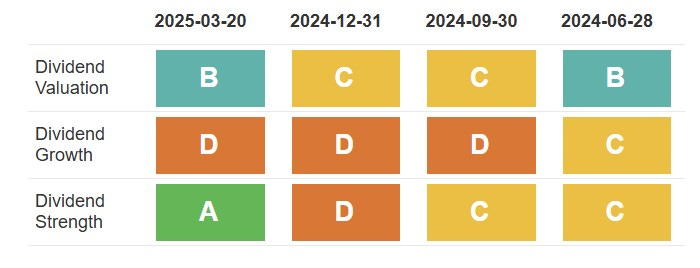

J.M. Smucker’s Dividend Valuation Grade is B (good value). The stock’s current dividend yield of 4.0% is above its five-year average high of 3.6%. This implies that the stock is currently undervalued.

The Dividend Growth Grade is D (weak). J.M. Smucker raised its dividend by just 1.9% last July, which was the smallest increase in many years. (The small increase occurred following the prior-year acquisition of Hostess.)

Trailing 12-month operating cash flows are down due to a drop that occurred in the company’s fiscal fourth-quarter 2024 ended in April 2024. Return on assets (ROA) is negative due to noncash impairment charges realized last quarter related to the 2023 acquisition of Hostess.

The Dividend Strength Grade is A (very strong). J.M. Smucker has not had a single dividend cut in the last 24 years. Interest payments are manageable, with a times interest earned ratio of 4.4x.

Dividend Pillars for SJM

Source: AAII. Data as of 3/20/2025.

PepsiCo Gets Into Prebiotic Sodas

PepsiCo announced its intention to acquire prebiotic soda company Poppi this week.

Prebiotic sodas are the fastest-growing part of the soft drink market, with demand driven by health-conscious consumers. Buying Poppi saves PepsiCo the time and expense of trying to break into this market with an internally created drink.

According to an Exane BNP Paribas report cited by Reuters, Poppi has an approximate 1% share of the total carbonated soft drinks category. Therefore, PepsiCo’s acquisition immediately gives it a strong foothold in this emerging segment.