China's DeepSeek AI Rattles Utility Stocks, but Not American States Water

January 31, 2025 | Explore how AI developments are impacting utility stocks, plus get updates on dividend increases, earnings surprises, and the latest from AAII’s Dividend Investing portfolio.

Since utility stocks are often desired by individual investors for their dividends, I discuss the implications of AI growth on the sector before moving on to this week’s earnings and dividend news.

Here are the deets:

American States Water Co.’s (AWR) utility Golden State Water Co. allowed its stock to sidestep the utility sector’s downward volatility.

Eastman Chemical Co. (EMN) and Quest Diagnostics Inc. (DGX) both had positive earnings surprises this week, while Tractor Supply Co. (TSCO) missed expectations.

BlackRock Inc.’s (BLK) latest dividend increase was not large enough to quell concerns about its valuation.

The AI Fallout on Utility Stocks

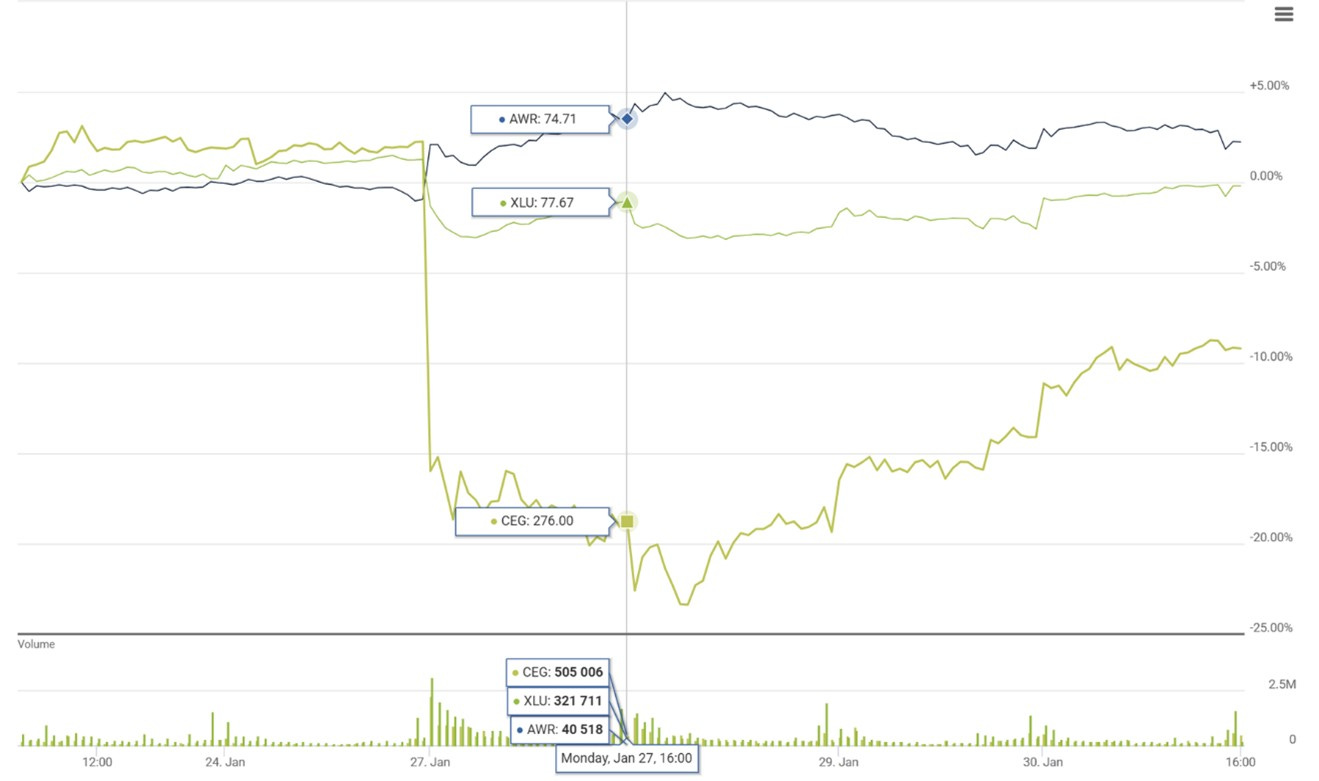

Shares of several utility companies fell on Monday in reaction to China’s DeepSeek AI model running on lower-power processors. The Utilities Select Sector SPDR ETF (XLU) fell 2.3%, with many utility stocks losing far more. Constellation Energy Corp. (CEG), for example, plunged nearly 21%. (Constellation Energy is the Utilities Select Sector SPDR’s’ second-largest holding.)

American States Water was among the sector’s standouts on Monday, gaining 4.5%. A big reason is its public water utility Golden State Water. Golden State Water accounted for 72% of American States Water’s revenues during the first nine months of 2024. Electricity generation accounted for less than 7% of the company’s total revenues over the same period.

The utility companies whose stock prices were beaten down the most on Monday were those perceived as benefiting from growth in data centers. AI requires considerable energy in its current state. This has driven valuations for many utility energy companies higher.

Constellation Energy has been one such beneficiary of the AI boom. It derives its revenues from generating electricity. The company touts increasing data center usage as a growth driver in its presentations. DeepSeek poses a threat to Constellation Energy’s earnings outlook because it holds the potential for requiring less energy usage. (Whether DeepSeek is as good as advertised remains to be seen.)

Monday’s AI Sell-Off Had Differing Impacts on Utility Stocks

Five-day returns for American States Water, Constellation Energy and the Utilities Select Sector SPDR. Prices as of the close on Monday, January 27, 2025, are annotated.

Source: QuoteMedia. Data as of 1/30/2025.

American States Water and Constellation Energy are examples of how diversification exists within sectors. While the Dividend Investing (DI) strategy does not have a set limit on the number of companies from any one sector that are held within the model portfolio, consideration is given to what impact each company’s business will have on the portfolio’s overall diversification.

We cannot measure the DI model portfolio’s exposure to AI. While companies within the portfolio are seeking ways to integrate AI (e.g., Quest Diagnostics), none have described AI as having a significant impact on their revenues or earnings.

Comparing American States Water and Constellation Energy on Dividend Pillars

Since both are stocks are being discussed, it is worth comparing American States Water and Constellation Energy from a DI perspective. This is difficult to do because Constellation Energy has a limited history as a stand-alone company. It was spun off from Exelon Corp. (EXC) in 2022.

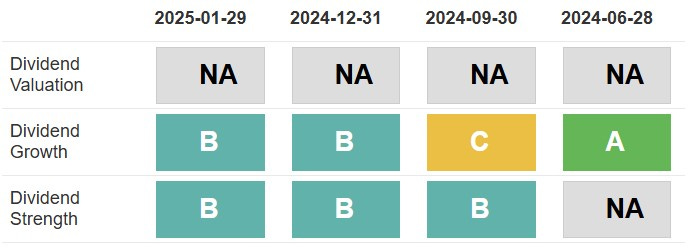

Here’s what I can tell you. Constellation Energy’s current yield of 0.5% matches its average low for 2022 and 2023. The company raised its dividend 25% last February. Constellation Energy’s Dividend Growth and Dividend Strength Grades are both B.

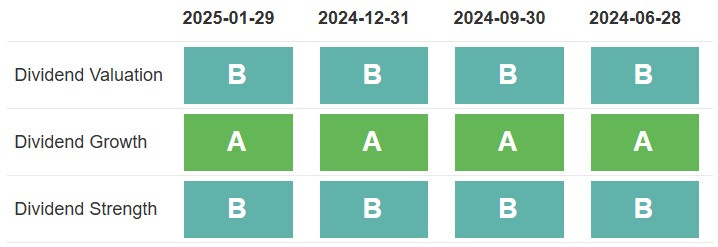

American States Water yields 2.4%. This yield is above the stock’s current five-year average low, implying an attractive valuation. The company has raised its dividend for 70 consecutive years. The most recent dividend increase was an 8.3% hike announced in August 2024. American States Water has a Dividend Growth Grade of A and a Dividend Strength Grade of B.

Dividend Pillars for CEG

Dividend Pillars for AWR

Source: AAII Dividend Investing. Data as of 1/29/2025.

Eastman Chemical and Quest Diagnostics Beat, While Tractor Supply Disappoints

Eastman Chemical and Quest Diagnostics both reported positive earnings surprises. Earnings for Tractor Supply were below analysts’ expectations. Guidance from the three companies was mixed.

Eastman Chemical’s fourth-quarter 2024 adjusted earnings were well above the S&P Global consensus estimate. The midpoint of the company’s 2025 guidance was a bit below expectations: $8.375 per share versus $8.464 per share. However, the range of Eastman Chemical’s guidance was wide at $8.00 to $8.75 per share. The Kingsport, Tennessee, methanolysis facility, which came online last March, is expected to add $75 million to $100 million of incremental earnings before interest, taxes, depreciation and amortization (EBITDA) this year. We estimate Eastman Chemical’s adjusted EBITDA to have been $1.4 billion in 2024.

Quest Diagnostics topped analysts’ earnings expectations by 2.3%. Operating margins widened on both a GAAP and adjusted basis. However, the $9.675 per share midpoint of the company’s full-year 2025 earnings guidance was slightly below the S&P Global consensus estimate of $9.72 per share. Quest Diagnostics expects potential downward profit margin pressure from hospitals but growth in both Medicare and autoimmune disorders.

Quest Diagnostics also raised its dividend to $0.80 per share. The increase was within the range of the previous two hikes both on an absolute basis ($0.05 per share) and on a percentage basis (6.7%).

Tractor Supply earned $0.44 per share in the fourth quarter of 2024. Earnings missed the S&P Global consensus estimate by 4.4%. The $2.16 per share midpoint of Tractor Supply’s full-year 2025 earning guidance was above the pre-earnings-release consensus estimate of $2.056 per share. CEO Hal Lawton told analysts that he anticipates “the headwinds we’ve been facing will moderate as we move through [2025].” The headwinds have included more cautious consumer spending. CFO Kurt Barton followed by saying, “our guidance does not assume any changes in tariffs at this time.”

This week’s reports bring the DI portfolio’s fourth-quarter 2024 earnings scoreboard to four beats, two in-line reports and one miss.

Dividend News

BlackRock declared a regular quarterly dividend of $5.21 per share, a 2.2% increase from the prior declaration. The increase was slightly larger than last year both on an absolute and percentage basis. Even with Friday’s hike, BlackRock’s yield of 1.9% compares to a five-year average low of 2.0%. This makes the stock’s valuation pricey. No action is being taken on the stock yet. The new dividend is payable on March 24, to shareholders of record as of March 7. The stock will trade ex-dividend on Friday, March 7.

As noted above, Quest Diagnostics raised its regular quarterly dividend. The new dividend is payable on April 21, to shareholders of record as of April 7. The stock will trade ex-dividend on Monday, April 7.

Huntington Ingalls Industries Inc. (HII) declared a regular quarterly dividend of $1.35 per share, in line with the prior declaration. The dividend is payable on March 14, to shareholders of record as of February 28. The stock will trade ex-dividend on Friday, February 28.

After the market close on Friday, January 24, J. M. Smucker Co. (SJM) declared a regular quarterly dividend of $1.08 per share, in line with the prior declaration. The dividend is payable on March 3, to shareholders of record as of February 14. The stock will trade ex-dividend on Friday, February 14.

No stocks are scheduled to trade ex-dividend or pay dividends next week.

The DI model portfolio will get a barrage of earnings reports next week. Amgen Inc. (AMGN), PepsiCo Inc. (PEP) and Pfizer Inc. (PFE) will report on Tuesday, February 4. IDEX Corp. (IEX) and Skyworks Solutions Inc. (SWKS) will report on Wednesday, February 5, followed by Huntington Ingalls Industries, Snap-on Incorporated (SNA) and Hershey Co. (HSY) on Thursday, February 6.

Let’s hope the groundhog doesn’t see his shadow on Sunday. My wife and I are planning to go out to Woodstock, Illinois, early on Sunday to see the prognostication in person. Woodstock is where the 1993 movie “Groundhog’ Day” was filmed. Hopefully, Ned Ryerson won’t want to talk to us about insurance.