Decoding 10-K Filings: What Tractor Supply's Report Tells Us

February 21, 2025 | Learn how to analyze a company’s Form 10-K for key dividend insights, plus get updates on Tractor Supply’s dividend grades and recent earnings surprises in the AAII Dividend Invest

With many companies having recently filed their Form 10-K with the U.S. Securities and Exchange Commission (SEC), I show you what I look for in these reports. I also review Tractor Supply Co. (TSCO)’s Dividend Grades and provide color on the latest Dividend Investing (DI) model portfolio holdings’ earnings reports. TGIF!

As always, here are deets:

Skimming the Form 10-K identifies key information about a company, including any notable risks related to its business or accounting practices.

Tractor Supply’s current dividend yield matches its five-year average, but the stock has strong grades for dividend growth and strength.

Both American States Water Co. (AWR) and Medtronic PLC (MDT) reported positive earnings surprises.

Tractor Supply’s 2024 10-K Filing

If you have ever looked at a company’s annual report, you’ve noticed two parts. The first is the glossy overview of the company. The second the Form 10-K. The 10-K is an annual filing required by the SEC. It discusses a company’s business model, outlines its risks and details its finances.

Large companies whose fiscal years align with the calendar year have mostly filed their Form 10-Ks by now. Our data provider, S&P Global Market Intelligence, pulls the financial information from them and sends it to us. We, in turn, update the data you see on our website and, of course, the Dividend Grades.

You can find the Form 10-K and other filings in the SEC’s EDGAR database.

I skim through the Form 10-K rather than read it word for word. Here are some of the things to look at.

Business: An explanation of what the company does is provided. The level of detail varies by company. Tractor Supply gives a very good overview of its business model and operations. Livestock, equine and agriculture accounted for 26% of total sales in 2024. Companion animals (e.g., dogs and cats) accounted for 25% of sales, followed by seasonal and recreation products at 23%.

Risk Factors: Much of this tends to be disclosures of what could happen. For instance, Tractor Supply lists “failure to protect our reputation” as the first risk factor—an obvious blanket statement intended to protect the company from lawsuits. It is the same thing with dividends: “We cannot provide any guaranty of future dividend payments or any guaranty that we will continue to repurchase our common stock pursuant to our stock repurchase program.” I gloss over the obvious risks and look for anything unusual. One such example was a potential tax problem in Brazil listed by a company I had looked at several years ago. Nothing in Tractor Supply’s risk factors seems unusual.

Management’s Discussion of Financials and Operations: There can be more details given about the business’ results than are provided in the earnings release. I’ll go to this section if there is something on the financial statements I want more clarification on or if I’m researching a new stock.

Auditor’s Report: You always want to see the accounting firm describe the financials as being presented fairly with no questionable assumptions. Tractor Supply passes this test.

Notes to the Consolidated Financial Statements: If a company wants to brush over questionable accounting practices, this is where you find out. The company’s accounting policies are discussed here, and financial disclosures are given. You may also find interesting tidbits here. Tractor Supply disclosed that it paid an average of $53.02 per share to buy back its stock last year. As of the close on Thursday, February 20, 2025, the stock traded at $57.74 per share.

The fact that I did not see anything more notable about Tractor Supply is a good sign. You generally do not want to be surprised by any of the disclosures made in the Form 10-K.

Tractor Supply’s Dividend Grades

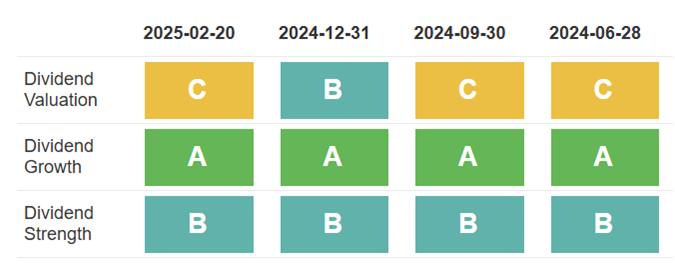

Since I am talking about Tractor Supply, let’s take an updated look at its Dividend Grades.

The stock’s Dividend Valuation Grade is C (average). Its current yield of 1.6% is even with its five-year average. This implies that Tractor Supply is fairly valued.

The Dividend Growth Grade is A (very strong). Tractor Supply’s 11.6% return on assets (ROA) for 2024 ranks in the top decile of all companies in our database. The stock’s five-year annualized dividend growth rate of 26.5% is among the strongest of all companies. I do expect the Dividend Growth Grade to weaken somewhat given the 4.5% dividend hike Tractor Supply announced last week.

The Dividend Strength Grade is B (strong). The earnings payout ratio of 43% has been rising over the past several years but is still reasonable on an absolute basis. Tractor Supply has a total-liabilities-to-total-assets ratio of 76.8%. Though high, the company’s times interest earned ratio is very strong at 26.9%. Only 6% of all companies in our database have a stronger times interest earned ratio.

Dividend Pillars for TSCO

Source: AAII Dividend Investing. Data as of 2/20/2025.

Two More Earnings Beats This Week

American States Water gushed passed expectations, beating the S&P Global consensus estimate by 18.4%. This was the third-largest positive surprise among the DI model portfolio holdings for this earnings season. Earnings were aided by the final rate decision for the company’s water utility subsidiary, Golden State Water Co. American States Water had previously said that the rate decision announced last month would have a retroactive impact on its fourth-quarter 2024 earnings.

Medtronic’s fiscal third-quarter 2025 beat of 2.2% was just big enough to qualify as a positive surprise. Adjusted gross margins widened by 50 basis points (0.5%) thanks to the company’s “efficiency programs,” higher prices and revenues attributable to more profitable products. The company reiterated its previously raised fiscal-year 2025 guidance for adjusted earnings of $5.44 to $5.50 per share. The S&P Global consensus estimate continues to hold steady at $5.454 per share.

This week’s two positive surprises improve the DI model portfolio’s fourth-quarter earnings scoreboard to 13 positive surprises, one negative surprise and six in-line reports.

Dividend News

No companies declared dividends this week.

Four model portfolio holdings will trade ex-dividend next week: Skyworks Solutions Inc. (SWKS) and Snap-on Incorporated (SNA) on Monday, February 24; Tractor Supply on Wednesday, February 26, and Huntington Ingalls Industries Inc. (HII) on Friday, February 28.

No model portfolio holdings will pay dividends next week.

Home Depot Inc. (HD) will announce its latest earnings on Tuesday, February 25, followed by J.M. Smucker Co. (SJM) and EOG Resources Inc. (EOG) on Thursday.