Dividend Stocks Held Up Better During March's (and Yesterday's) Volatility

April 4, 2025 | Dividend stocks outperformed in March’s market correction. See how AAII’s DI portfolio held up, plus insights on tariffs, yields, and top performers.

When market conditions turn tough, dividend stocks often hold up better. This was the case in March, and it was the case yesterday. The Dividend Investing (DI) model portfolio didn’t walk away unscathed either time, but it still outperformed.

The big news this week was President Donald Trump’s tariff announcements. Global stock markets reacted negatively yesterday in response. In particular, the major U.S. indexes opened down and extended their losses late into the day. I provided guidelines and perspectives for staying invested during this uncertainty in yesterday’s Investor Update.

I expect we will get a better understanding of the impact tariffs will have on U.S. corporations in the coming weeks as companies provide updated revenue and earnings guidance in their first-quarter 2025 reports.

Here are this week’s deets:

The DI model portfolio beat its benchmark, the iShares Dow Jones U.S. ETF (IYY), for a third consecutive month in March.

Seven model portfolio holdings rose in value last month, and an additional 10 holdings fared better than the iShares Dow Jones U.S. ETF.

Huntington Ingalls Industries Inc.’s (HII) dividend yield of 2.7% implies that the stock is attractively valued.

March Roared Like an Angry Lion

The S&P 500 index suffered its biggest monthly drop in more than two years during March. The blue-chip index shed 5.6% of its value during the month. The iShares Dow Jones U.S. ETF fared even worse. It lost 5.8% in March. (As a quick aside, the S&P 500 lost 4.8% yesterday while the iShares Dow Jones U.S. ETF plunged 5.0%. The DI model portfolio only declined 2.8%.)

Uncertainty over tariffs and the extent of the economic headwinds they could cause were the primary reasons for the downward pressure. High valuations have helped technology-related stocks get scorched like a piece of wood thrown into a bonfire. Information technology, consumer discretionary and communication services—which account for nearly 50% of the S&P 500’s market capitalization when combined—were the worst-performing sectors.

Dividend stocks held up better. The S&P 500 Dividend Aristocrats index, which tracks large-cap companies that have raised their dividends for at least 25 consecutive years, declined 1.3%. The DI model portfolio beat out the S&P 500 Dividend Aristocrats with a 1.2% decline.

March was the third consecutive month that the DI model portfolio has outperformed the iShares Dow Jones U.S. ETF. The ETF holds over 1,000 of the largest U.S. stocks. The DI model portfolio ended March with a year-to-date gain of 1.5%. The iShares Dow Jones U.S. ETF was down 4.6% on a year-to-date basis.

During March, seven DI model portfolio holdings realized gains.

The biggest gainers were Huntington Ingalls Industries and UnitedHealth Group Inc. (UNH). Shares of Huntington Ingalls Industries surged 16.2% following a call by President Trump to resurrect the U.S. shipbuilding industry. Scroll down for more about Huntington Ingalls Industries.

UnitedHealth Group rebounded as well. The stock gained 10.3% in March after being knocked down in February over allegations about its Medicare billing practices. The lack of any additional news helped the stock. Also playing a role is the lower economic sensitivity of health care stocks relative to other sectors.

Seventeen model portfolio stocks fell in value last month. Ten of them realized smaller losses than the iShares Dow Jones U.S. ETF did.

Nike Inc. (NKE) was the worst performer. It was kicked downward 20.1% after providing disappointing revenue and earnings guidance. The company is updating its strategy and product line. Tariff concerns led to big price drops in many footwear makers yesterday, including Nike, On Holding AG (ONON) and Hoka brand owner Deckers Outdoor Corp. (DECK).

There wasn’t any company-specific news to blame for Eastman Chemical Co.’s (EMN) 10.0% slide. The decline likely reflects market concerns about potential tariff impacts.

The DI model portfolio’s yield was 2.6% at the end of March. The iShares Dow Jones U.S. ETF’s yield, in comparison, was just 1.0%. The ETF paid its quarterly distribution a couple of weeks ago.

Pfizer Inc.(PFE) remained the highest-yielding stock in the model portfolio. Its yield was 6.4% at the end of March.

IDEX Corp. (IEX) continued to have the lowest yield at 1.4%.

BlackRock Inc. (BLK) remains the only model portfolio holding with a Dividend Valuation Grade of F. Its 2.1% yield is barely above its five-year average low of 2.0%. A drop below 2.0% would give the DI approach reason to consider replacing the stock.

Huntington Ingalls Industries Sails With an Attractive Valuation

Huntington Ingalls Industries designs and builds military ships and related technologies. Its largest segment by revenue, Newport News Shipbuilding ($6.0 billion), constructs nuclear-powered aircraft carriers and submarines. Ingalls ($2.8 billion) construct nonnuclear ships for the U.S. Navy and U.S. Coast Guard. The mission technologies segment ($2.9 billion) focuses on technology and processes for military operations and information gathering, cyber warfare, warfare training simulations, and other related services and products.

The U.S. Navy accounted for 80% of the company’s revenues last year. The U.S. Coast Guard and the U.S. Department of Defense (DOD) are the other big customers.

Consolidated revenues increased 0.7% last year. Earnings per share totaled $13.96 per share, down from $17.07 per share in 2023. Staffing issues stemming from the pandemic adversely impacted margins in 2023. The S&P Global consensus estimate calls for earnings to decline to $13.32 per share this year before rebounding to $15.75 per share in 2026.

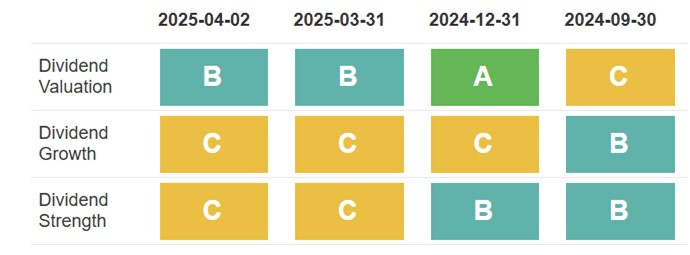

Shares of Huntington Ingalls Industries yield 2.7%. This is near the company’s five-year average high yield of 2.9%. The company repurchased 608,000 shares last year. Those buybacks led to a 1.5% reduction in the share count. Combined, the dividend yield and shareholder yield equate to a Dividend Valuation Grade of B (good value).

Huntington Ingalls Industries’ Dividend Growth Grade is C (average). The company raised its dividend by 3.8% last October. This was the fourth consecutive year that dividend increases were limited to approximately 5% or less. Cash flow from operating activities fell last year due to a decline in earnings and an increase in accounts payable and accruals.

The stock’s Dividend Strength Grade is also C (average). Huntington Ingalls Industries’ earnings payout ratio of 37.6% is high relative to its sector peers. While acceptable on an absolute basis, it is also at a five-year high for the company. Meanwhile, the times interest earned ratio of 7.3x is strong. Huntington Ingalls Industries has raised its dividend for 12 consecutive years.

Dividend Pillars for HII

Source: AAII Dividend Investing. Data as of 4/2/2025.

First-Quarter Earnings Season Is Officially Upon Us

First-quarter 2025 earnings season for companies operating on calendar-year quarters will start next week with large financial companies reporting. BlackRock will announce its results in the morning on Friday, April 11.