Dividend, Value and Low-Volatility Stocks Are Faring Better This Year

March 14, 2025 | The S&P 500 is in correction, but dividend and value stocks are outperforming. See why AAII added Oshkosh to its DI portfolio.

The S&P 500 index is now in a correction. The index closed more than 10% below the record high set just last month. This does not mean all S&P 500 stocks are in a correction. There are some that are faring better: dividend payers, value stocks and low-volatility stocks.

First, as always, I start with the deets:

Corrections are normal part of the market cycle; they occur, on average, once every three years.

The Dividend Investing (DI) model portfolio has been less volatile than the broader market while also providing a stream of income.

Last week’s addition, Oshkosh Corp. (OSK), was chosen over seven other stocks. I explain why they were passed over.

Corrections Aren’t Pleasant, but Dividends Ease the Pain

Headline risk is causing volatility to be high in the stock market. It is becoming increasingly difficult to determine what tariffs have been raised, levied, lowered or rescinded. This uncertainty makes it difficult for businesses to plan and budget. It also makes it difficult for economists to make projections about the economy.

The S&P 500 entered a correction yesterday, closing down 10% from its record high that was set just last month. While such drops always attract attention, they are not unusual. CFRA Research’s Sam Stovall counts 24 prior corrections as having occurred since the end of World War II—once every three years, on average.

Corrections are a normal part of the market cycle. While painful, they tend to bottom in a little over two months. Full recoveries take an additional four months to occur. The entire process feels longer because Mr. Market likes to take the elevator down and the stairs up.

Dividends help to ease the pain of market drops by providing an ongoing stream of portfolio income. To get the income, you must stay invested. No stocks = no dividends.

If you are nervous about the current market, I encourage you to read my latest Investor Update commentary where I offer suggestions for coping with a volatile market environment.

The Market’s Shift in Favor of Dividend Stocks

Bouts of market uncertainty often cause investors to seek less-volatile assets, including those that provide a stream of income. We have seen this play out with the DI portfolio. Year to date, the portfolio continues to outperform the iShares Dow Jones U.S. ETF (IYY), which tracks a broad market index.

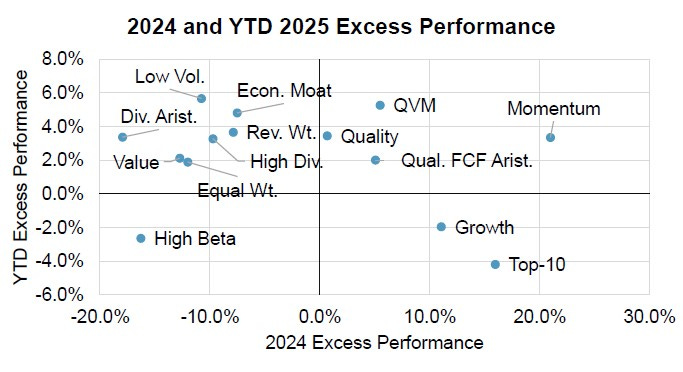

The chart below from S&P Dow Jones Indices illustrates this. Focus particularly on the upper-left quadrant; it shows the subset indexes representing the type of

S&P 500 member stocks that fared the best during the first two months of this year. They include low-volatility, dividend-paying and value stocks.

Source: S&P Dow Jones Indices’ February 2025 Dashboard for S&P 500 Factor Indices.

The DI strategy not only places an emphasis on dividend growth, it also emphasizes value. The DI model portfolio has also been less volatile than the market, as indicated by its three-year risk index of 0.97. (Values below 1.0 indicate less volatility than the market.) The DI approach doesn’t purposely seek out stocks with low volatility (or low betas), but it does try to avoid highly volatile stocks.

Additionally, the DI model portfolio holds companies with the financial capability to pay and continue raising their dividend. Capturing this stream of income requires you to stay invested at all times.

Candidates Considered Before Choosing Oshkosh

A portfolio addition alert for Oshkosh was issued last week. The stock was chosen for its good Dividend Grades, attractive relative yield and strong dividend growth.

The selection process for choosing Oshkosh involved running the entire DI Ideas list through the Dividend Screener to narrow the list to just those stocks with Dividend Grades of A or B for all three dividend pillars. The passing stocks were then sorted by yield (highest to lowest) before due diligence was conducted. Oshkosh was the most attractive stock of the group.

Here are other candidates that were considered and the reasons they were not chosen:

Avery Dennison Corp. (AVY): Its dividend growth has been good over the past few years, but its 1.9% yield (as of last week) was below Oshkosh’s 2.0% yield.

Boise Cascade Co. (BCC): Once the stock’s five-year average yield was adjusted for its special dividend, it no longer appeared to be trading at a discounted valuation.

Merck & Co. Inc. (MRK): It yields 3.5%, but the DI model portfolio already owns four other health care stocks.

Northrop Grumman Corp. (NOC): This defense company was also passed on for diversification reasons. Most of DI holding Huntington Ingalls Industries Inc.’s (HII) revenues come from the U.S. Department of Defense (DOD) as well. Plus, the stock’s 1.8% yield was lower than Oshkosh’s yield.

Qualcomm Inc. (QCOM): It had a slightly higher yield than Oshkosh, but the latter has stronger dividend growth. Additionally, Apple Inc. (AAPL) currently accounts for 20% of Qualcomm’s revenues, and this is anticipated to drop starting in 2027.

RLI Corp. (RLI): This company’s dividend growth is slowing, and the size of its special dividends has been inconsistent.

R. Berkley Corp. (WRB): There has been inconsistent growth in its regular dividend and its special dividend is variable.

Earnings Return Next Week

The first-quarter 2025 earnings season is starting right on the heels of fourth-quarter 2024 earnings season. Nike Inc. (NKE) will report its quarterly results on Thursday, March 20.