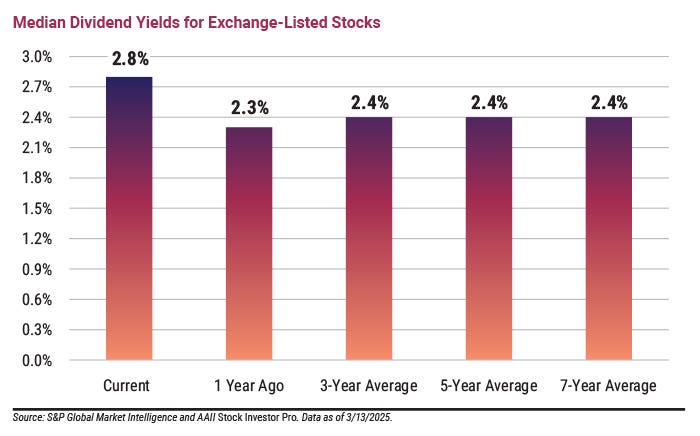

Dividend Yields Are Higher Now Than in Recent Years

Stocks with yields significantly higher than current medians are alluring, but it’s essential to thoroughly analyze the stock before investing.

Dividend yields for exchange-traded stocks are not only above their year-ago levels but also above their average yields for the past several years.

Two factors determine a stock’s dividend yield.

The first is the stock’s price. Dividend yields are calculated by dividing the 12-month indicated yield by the share price. This leads to an inverse relationship between yield and valuations. The yield decreases as a stock’s price increases. The yield rises when a stock’s price falls. The latter has happened so far this year as of press time.

The second factor is rate of dividend growth. Yields rise when dividend growth is stronger than the stock price’s rate of increase. When the stock’s price rises faster than the dividend’s growth rate, the yield decreases.

The median yield for dividend-paying exchange-traded stocks was 2.8% as of mid-March 2025. This compares to the three-, five- and seven-year median yields of 2.4%. (We required stocks to have a minimum market capitalization of $30 million and a minimum share price of $5.00.)

There is a size effect in these numbers. When we exclude S&P 500 index stocks from the universe of dividend payers, the median current yield rises to 3.0%. Average three-, five- and seven-year yields are also slightly higher at 2.5%. This difference reflects the higher valuations that large-cap stocks trade at.

Median yields are useful for understanding what is a high or low yield in the current market environment. Average yields are higher because of the skewing effect of the highest-yielding stocks. The average yield for all stocks (including S&P 500 members) is 3.7%. This is up from the three-, five- and seven-year average yields of 2.9%.

While we understand the allure of seeking stocks with yields significantly higher than current medians, it’s essential to thoroughly analyze the stock first. High yields can signal significant risks. Review the company’s financial statements to ensure it is profitable and the dividend can be maintained or, ideally, grown over time. It is also prudent to examine the company’s dividend policy and business model before making investment decisions based on yield alone.