Finding a Dividend Stock to Love With the Dividend Screener

February 14, 2025 | Discover how to use AAII’s enhanced Dividend Screener to find high-quality dividend stocks, plus get the latest earnings and dividend updates.

One of the valuable tools on the Dividend Investing (DI) website is the AAII Dividend Screener. We made an enhancement to the screener this week in response to a subscriber’s request. I share what we did and show you how to take advantage of this powerful tool.

Before I do, here are this week’s deets:

The AAII Dividend Screener offers you several ways to filter for attractive dividend-paying stocks.

Cincinnati Financial Corp. (CINF) reported a very big earnings surprise; CME Group Inc. (CME) also beat the consensus estimate.

Tractor Supply Co. (TSCO) raised its dividend, though the size of the increase was smaller than it has been in past years.

The U.S. financial markets and the AAII office will be closed on Monday, February 17, in observance of Presidents Day.

Identifying Attractive Dividend Stocks With the Dividend Screener

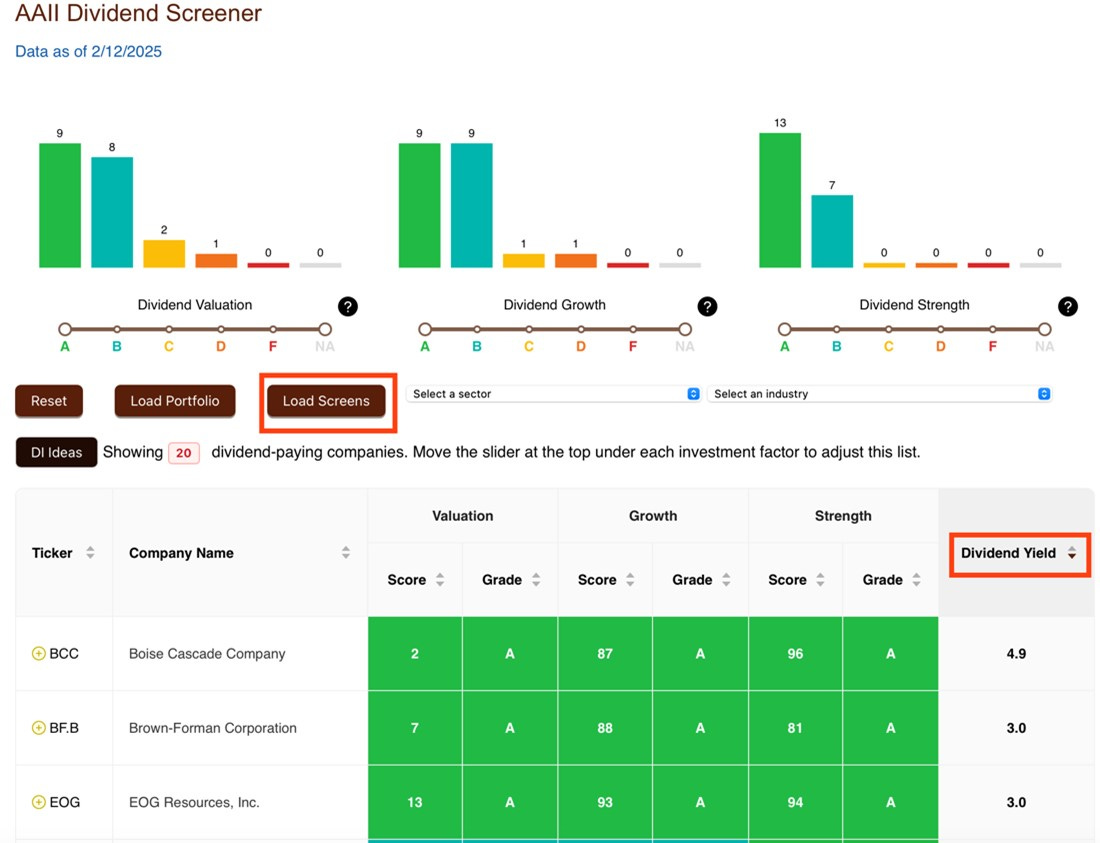

The AAII Dividend Screener allows you to filter through U.S.-listed dividend-paying stocks based on the three pillars of the DI approach: valuation, growth and financial strength. The screener can be accessed on the AAII Dividend Investing website by selecting “Tools” on the menu at the top of the screen and then clicking “Dividend Screener.”

Currently, 2,049 dividend-paying stocks are included in the screener. These stocks have an indicated dividend greater than $0.00 and a dividend yield above 0%. We recently added the latter requirement to ensure that companies without a yield were excluded from the screener.

To screen for stocks, simply use the sliding bars below one or more of the three Dividend Grades. Each grade corresponds to one of the DI approach’s dividend pillars. The list of passing stocks will automatically adjust.

Let’s say that dividend strength matters most to you. You can set the Dividend Strength Grade to A. If you then require the Dividend Valuation and Dividend Growth Grades to be D or better (to weed out the weakest stocks on both measures), the universe of dividend-paying stocks is narrowed down to 269 companies.

But Wait, There’s More!

You are not limited to screening just the entire dividend stock universe. You can screen your own portfolios. Clicking on “Load Portfolio” imports the dividend-paying stocks held in any portfolio you’ve set up on AAII.com via My Portfolio. We’ve preloaded the DI model portfolio as an option.

If you prefer to look through predefined lists of ideas, click on the “Load Screens” button. This will give you the option to load the DI Ideas list, AAII dividend-oriented screens (like the Dogs of the Dow screens) or any of the other AAII Stock Screens.

Clicking on the “Select a sector” or “Select an industry” drop-down menu allows you to screen by either sector or industry. This is helpful if you want to look at, say, banks or energy sector companies. You can also use these drop-down menus to narrow down the results of another screen. The High Relative Dividend Yield screen currently identifies 33 companies. If I load the screen and then select Utilities from the sector drop-drown menu, the list of passing companies is narrowed down to seven.

For the screenshot below, I loaded the DI Ideas list into the screener. I narrowed the list to those stocks with Dividend Grades of A or B. I then sorted the results by yield, highest to lowest. (The table can be sorted by any of the column headings. Just click on the one you want to sort by.) Boise Cascade Co. (BCC), the highest-yielding stock on the DI Ideas list, will report earnings next Friday.

Finally, you can add any stock on the screener results that interests you to one of your existing My Portfolios (or a new one) by clicking on the plus sign by the ticker symbol.

Positive Earnings Surprises From Cincinnati Financial and CME Group

Both Cincinnati Financial and CME Group reported positive surprises when they announced their fourth-quarter earnings this week. This week’s results bring the DI portfolio’s fourth-quarter 2024 earnings scoreboard to 11 positive surprises, six in-line reports and one miss.

Cincinnati Financial’s non-GAAP earnings were 68.3% above analysts’ expectations. An improved combined ratio (insurance benefits paid out relative to premiums received) and higher net income contributed to the positive surprise. CEO Steve Spray expects the recent California wildfires to lead to first-quarter 2025 “pretax catastrophe losses of approximately $450 million to $525 million net of reinsurance recoveries.”

CME Group’s fourth-quarter 2024 adjusted earnings were 3.1% better than analysts expected. In the earnings conference call, the company’s executives repeatedly talked about expanding into the retail market, as they see more advisers and individual investors interested in futures contracts. When asked if CME Group has recently repurchased any of its stock, CFO Lynne Fitzpatrick explained that last year’s excess cash was spent on the recent special dividend.

Dividend News

Tractor Supply declared a regular quarterly dividend of $0.23 per share, a 4.5% increase from the prior declaration. This was the company’s smallest annual increase since it started paying dividends in 2010.

Eastman Chemical Co. (EMN), Nike Inc. (NKE) and Snap-on Incorporated (SNA) also declared quarterly dividends this week, all in line with their previous declarations.

No companies are scheduled to pay a dividend until the first week of March.

Medtronic PLC (MDT) will report earnings on Tuesday, February 18. American States Water Co. (AWR) will report on Wednesday, February 19.

Two stocks will trade ex-dividend next week: Hershey Co. (HSY) on Monday, followed by American States Water on Tuesday.

As mentioned above, the U.S. financial markets and the AAII office will be closed on Monday in observance of Presidents Day. Hopefully, you will have warmer temperatures than we will in Chicago, Illinois. The high on Monday is forecast to just be 10 degrees Fahrenheit. As our art director Annie would say, it is going to be two-pants weather!