Key Metrics That Signal Strong Dividend Growth Potential

Focusing on companies with a history of dividend growth and the financial strength to sustain it increases your odds of realizing higher total returns.

Looking for portfolio income that grows year after year — and keeps pace with inflation? Dividend growth stocks may be your best bet. In this article, you’ll learn how to spot the strongest dividend growers and avoid those at risk of a cut.

Key takeaways:

Benefits of dividend growth stocks, including inflation protection and higher total returns over time

Key factors to analyze dividend growth potential and warning signs of possible dividend cuts

Strategies for selecting financially strong companies with sustainable and increasing dividend payments

There are close to 2,000 exchange-traded companies that pay dividends. Many investors favor them for the ongoing stream of portfolio income they generate. Plus, the ongoing payment is a sign of fundamental strength. After all, a company that lacks adequate cash flow cannot afford to pay dividends.

Not all dividend payers are the same. Research by Ned Davis Research and Hartford Funds shows that dividend growers and initiators realize the highest returns. These stocks realized an annualized return of 10.2% on average between 1973 and 2023. In contrast, stocks of companies that keep their dividend unchanged returned 6.7% on average over the same period.

There is another reason to favor dividend growers: inflation. When dividend growth matches inflation, the dividend maintains its real (inflation-adjusted) value. This is obviously beneficial to those investors who use dividends to provide portfolio income.

Dividend growth is also beneficial to investors who reinvest dividends back into their portfolios.

In this article, I give insights into the types of stocks that grow dividends as well as guidelines for analyzing a company’s ability to grow their dividend. I also show you to how identify potential warning signs that a dividend is at risk of being cut.

What Types of Stocks Are Dividend Growers?

As of mid-March 2025, 1,037 exchange-listed companies have raised their dividends. These are companies whose indicated dividends (dividends expected to be paid over the next 12 months) are higher than their dividends paid over the past 12 months.

Two-thirds of these dividend growers are in the S&P Composite 1500 index. Of these, 313 are in the S&P 500 index, 189 are in the S&P MidCap 400 index and 188 are in the S&P SmallCap 600 index.

Overall, the median market capitalization of dividend growers is $5.5 billion.

While dividend-paying stocks are often perceived as large-cap stocks, the numbers show that this clearly isn’t the case. Dividend investors who limit themselves to just S&P 500 stocks miss out on many potentially attractive stocks.

The financials and industrials sectors have the largest numbers of dividend growers at 283 and 188 stocks, respectively. Dividend growers can be found in all sectors, allowing investors to create diversified portfolios with them.

Determining Dividend Growth

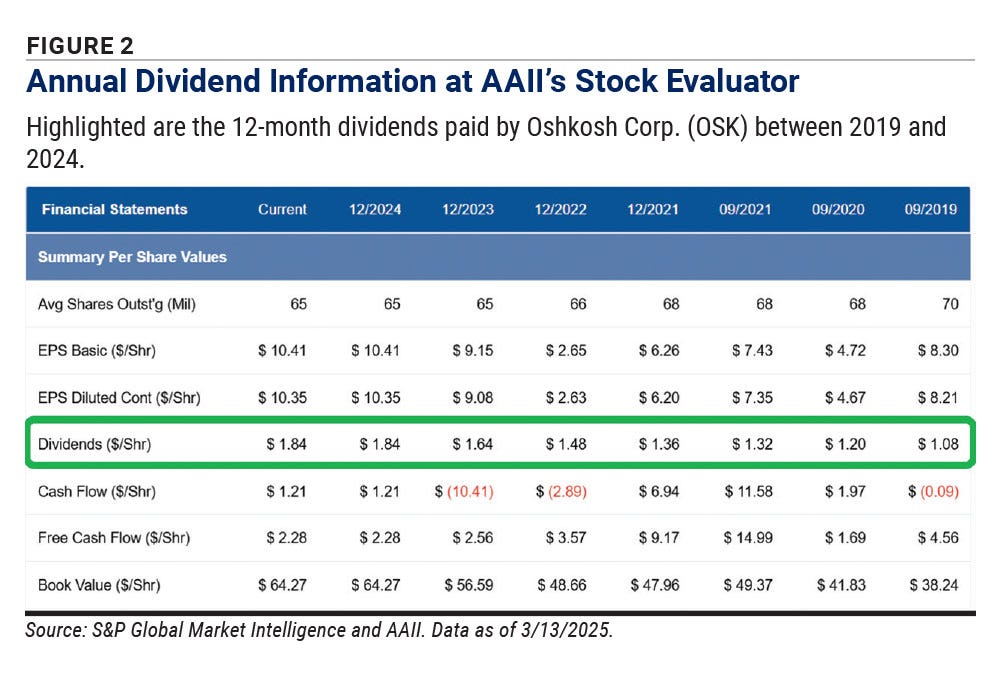

The simplest way to measure dividend growth is to compare the current dividend to the dividend from the same period one year ago. Vehicle maker Oshkosh Corp. (OSK) declared a $0.51 per share regular quarterly dividend in January 2025, 10.9% higher than the $0.46 per share regular quarterly dividend declared on January 30, 2024.

The compound annual growth rate (CAGR) gives you a better sense of a company’s history of raising dividends. Oshkosh has grown its dividend at an 8.9% annualized rate over the past five years. (Oshkosh is held in the AAII Dividend Investing model portfolio.)

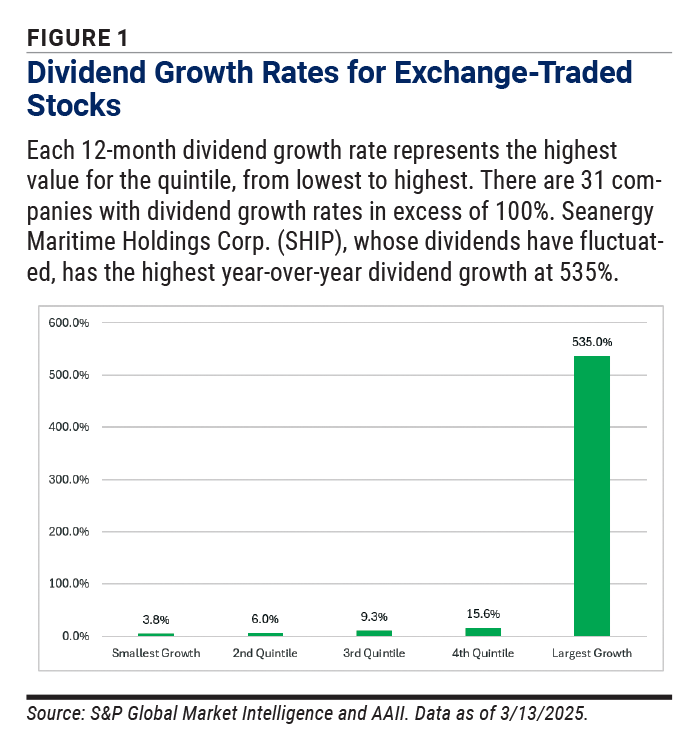

Figure 1 shows a quintile breakdown of how much current dividend growers have raised their dividend payments.

I find it helpful to look at both the growth rate and the year-by-year dividend history. The annualized growth rate can be skewed upward by large increases in the past and slow increases now. On the other hand, companies that announce bigger dividend increases now than they have in the past can be more attractive.

S&P Global Market Intelligence requires companies to increase their dividends for a minimum number of consecutive years to be members of its S&P 500 Dividend Aristocrats index. Specifically, companies must have “an increased total dividend per share amount every year for at least 25 consecutive years.” This allows a company to have skipped announcing a dividend hike during a calendar year if its total dividend payment in year Y was larger than the total dividends paid in year X.

Though many years of consecutive increases signal a commitment to dividend growth, the rate of growth must be considered. Some companies may regularly announce dividend increases but keep the absolute level of the dividend increase unchanged.

AT&T Inc. (T), for instance, limited the annual increase in its quarterly dividends to just $0.01 per share for 12 consecutive years. The first $0.01 increase equated to a 2.5% dividend hike in 2009. The last increase, in 2020, equated to a 1.9% dividend hike.

These small dividend hikes were enough to allow the stock to maintain its dividend aristocrat status. However, the increases were not large enough to help an investor who was counting on portfolio income to grow faster than the rate of inflation.

When seeking new stocks for the AAII Dividend Investing (DI) model portfolio, the DI approach favors companies with both a history of consecutive dividend increases and a growth rate that is greater than the rate of inflation. It looks not only at the annualized growth rate but also the year-by-year growth in the dividend.

(AT&T was one of the original stocks held when DI was launched in 2012. It was removed in 2016 due to its slowing dividend growth rate. AT&T eventually cut its dividend in 2022.)

Dividend Growth Requirements of the AAII Stock Screens

Many AAII Stock Screens either focus on dividends or have a dividend tilt. Two of them specifically require dividend growth.

The High Relative Dividend Yield screen requires passing companies to have increased their per-share dividend payout during each of the last six fiscal years. A factor screen, it has this requirement because a lack of dividend growth or a decline in the dividend growth rate can be troubling, especially after a period of regular annual dividend increases. The screen also requires a seven-year annualized dividend growth rate higher than 3.0%. This second criteria limits the results to those companies whose dividend growth is in excess of the long-term rate of inflation. (A higher minimum growth rate would be more restrictive.)

Among AAII’s guru screens, the Weiss Blue Chip Dividend Yield screen—our interpretation of Geraldine Weiss’ approach—also has a specific dividend growth requirement: Dividends must have increased a minimum of five times in the past 12 years. Weiss was more concerned about identifying stocks trading at discounted valuations with a long history of paying dividends (a minimum of 25 consecutive years) than with consistent dividend growth.

Dividend Investing’s Framework for Evaluating Growth

The AAII Dividend Investing approach uses four specific traits to measure dividend growth. Two are tied to the dividend itself; the other two are tied to the company’s ability to grow the dividend.

12-Month Dividend Growth: This trait looks at the change in the dividend per share paid over the last four quarters relative to dividends per share paid in the prior four-quarter period. A higher growth rate is better, though very high growth rates are not sustainable. Some companies use a different interval for raising their dividends, such as once every five quarters. These different intervals should be taken into consideration. Waiting one quarter after an expected dividend raise was not announced before selling can be justified if there is reason to believe the company may have simply delayed their dividend increase.

Five-Year Dividend Growth Rate: Dividend growth over the last five years looks at dividend reliability and how consistently a company has paid a dividend over time. Again, higher numbers are generally better as long as the dividend growth rate is not too high. It is helpful to look at annual changes in the dividend since previous strong growth may have pushed the number up, thereby masking slow recent growth. I personally like to look at the year-by-year changes in addition to the annualized growth rate. All AAII members can find year-by-year changes in dividends paid at a stock’s AAII Evaluator page. To access it, type a company’s name or ticker symbol into the search box near the top of any page on AAII.com. Chose the company from the list, then click on the Financials tab and scroll down to the Summary Per Share Values section (Figure 2).

Cash From Operations Growth: This trait compares the change in the cash from operations generated over the last four quarters to cash from operations generated in the four quarters one year ago. Cash flow from operations measures a company’s ability to generate and utilize cash from normal operations as it provides goods and services to its customers. Positive cash flow is required to pay the dividend. Rising levels of cash flow enable a company to continue growing its dividend.

Return on Assets (ROA): This ratio measures management’s ability and efficiency in using the company’s assets to generate operating profits. Return on assets also reports the total return accruing to all providers of capital (debt and equity). The ratio varies by sector and industry. Return on assets higher than industry or sector averages suggests a company realizes more profits from its assets than its peers do and is therefore better positioned to raise its dividend.

Signs of Dividend Strength and Weakness

Corporate executives may discuss their plans to grow dividends. Some companies may set a target for a dividend growth rate. Some will simply reiterate their intention to continue growing the dividend. Others may give a measure for dividend growth such as a payout percentage tied to reported or adjusted earnings.

Companies typically do not caution about a dividend not being raised as expected. Rather, they will simply declare a dividend payment that is unchanged instead of raising it. Investors must be aware of when the dividend has historically been raised (e.g., every January) to realize that a dividend increase was not announced this year.

There are four measures you can examine to judge the odds of future dividend growth occurring. Each is a component of the DI approach’s Dividend Strength Grade.

Earnings Payout Ratio: This is the percentage of earnings a company pays out as dividends. It is calculated by dividing annual dividends per share by annual earnings per share. The payout ratio helps an investor determine if earnings are sufficient to cover the dividend payment. Payout ratios differ among growth companies (a higher percentage of earnings are retained to fund expansion) and mature companies (more earnings are returned to shareholders). Payout ratios also vary by sector. The ratio should be below 100% and preferably much lower.

Times Interest Earned: Calculated as earnings before interest and taxes (EBIT) divided by interest expenses for the same period, the ratio shows the extent to which earnings exceed interest obligations. The higher the ratio, the less likely downward fluctuations in earnings will hurt a company’s ability to make its interest payments. Ratios near or above 100% can also trigger debt covenants that may lead to a cut or a suspension of dividend payments.

Ratio of Total Liabilities to Assets: Also known as the debt-to-total-assets ratio, it measures the percentage of assets financed by all forms of debt, both current and long term. The higher the percentage, the greater the potential for the company to violate its debt covenants and be forced to suspend its dividend.

Dividend Sustainability Ratio: This measure looks at how often a company has cut its dividend within the past seven years. A score of 100% means a company has never cut its dividend, which is desired. Companies that have previously cut their dividend may have weak fundamentals or are otherwise at risk of suspending their dividend all together.

Dividend Growth Leads to More Portfolio Income

Dividend growth stocks offer investors a stream of increasing portfolio income. By focusing on companies with a history of dividend growth and the financial strength to sustain it, investors increase their odds of realizing higher total returns.

Cash-flow-positive companies with moderate-to-low earnings payout ratios and consistent free cash flow tend to be the most dependable dividend growers. By emphasizing these quality indicators rather than simply chasing the highest current yield, investors can build a portfolio capable of generating increasing income streams that outpace inflation over the long term.