Looking at Earnings From a Dividend Investing Perspective

January 24, 2025 | Learn how to analyze earnings reports with insights from Abbott Labs and Texas Instruments, plus key dividend updates from AAII’s DI portfolio.

Since we are now in the heart of earnings season, I want to share the process I use for analyzing earnings reports from the standpoint of the holdings in the AAII Dividend Investing (DI) model portfolio. Abbott Laboratories (ABT), which reported fourth-quarter 2024 earnings this week, will be our example.

First, here are the deets:

Abbott Laboratories matched analysts’ fourth-quarter expectations. Its earnings guidance was also in line with expectations.

Texas Instruments (TXN) beat fourth-quarter earnings expectations but issued disappointing guidance.

Besides looking at the headline revenue and earnings numbers, I also scan through a company’s financial statements and its earnings conference call transcript.

How I Analyze Earnings Reports

Most people just look at quarterly earnings releases to see if revenues and earnings rose and whether earnings beat estimates.

Beyond these headline figures, there are many aspects of an earnings report you could dig into. A quick review can often give a lot of useful information without taking much of your time.

I personally start by looking at sales and earnings. In addition to looking for growth, I compare reported earnings to the S&P Global consensus estimate. Positive surprises are always preferred. I then scan through the financial statements by looking at how the numbers compare on a year-over-basis. (This is how I noticed the increase in Texas Instruments’ cost of revenues mentioned below.)

I also scan through the entire earnings release and then, if available, the conference call transcript. (Conference call transcriptions can be found on SeekingAlpha.com and might also be posted at the company’s investor relations website.) I particularly keep an eye out for any discussions about the dividend and any notable information regarding changes in the business or the company’s financial strength.

A DI Look at Abbott Laboratories’ Fourth-Quarter Earnings

Let’s start with the high-level summary. Abbott Laboratories earned $1.34 per share on an adjusted basis, essentially matching analysts’ expectations of $1.342 per share. The midpoint of Abbott Laboratories’ adjusted earnings guidance range of $5.05 to $5.25 per share for full-year 2025 matches the midpoint of S&P Global’s current consensus estimate of $5.155 per share. Sales are also projected to grow this year, though Abbott Laboratories will stop excluding coronavirus testing sales from its reported numbers. Coronavirus testing accounted for less than 2% of total sales in 2024.

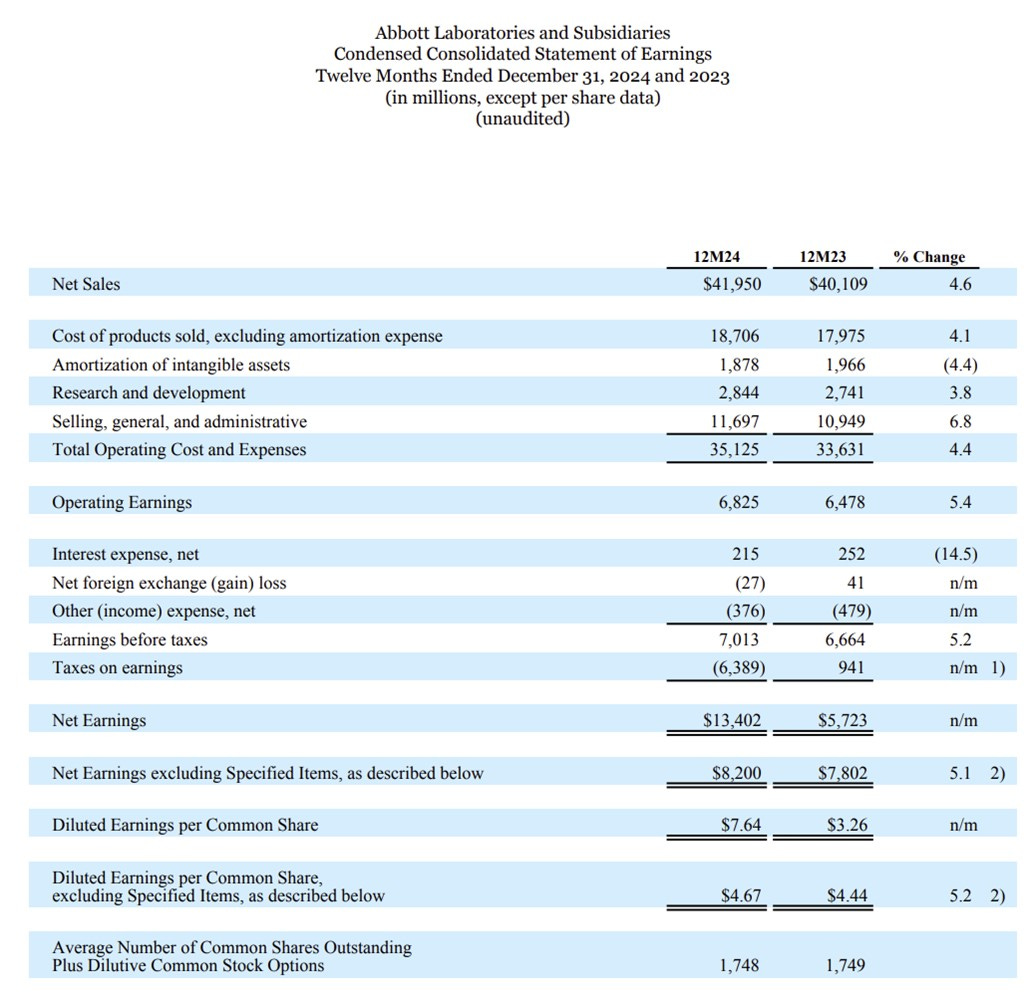

In terms of the AAII Dividend Grades, changes in shares outstanding will impact the Dividend Valuation Grade via the shareholder yield. Abbott Laboratories’ shares outstanding were essentially flat at the end of 2024: 1.748 billion versus 1.749 billion at the end of 2023, as shown in the income statement below. So, this should only have a negligible impact.

The Dividend Growth Grade considers 12-month growth in operating cash flow and dividends. The changes in both should be easy to judge this time of year since companies are reporting full-year 2024 data.

Unfortunately, many companies do not include their cash flow statements in their earnings releases. Abbott Laboratories is one of them. Abbott Laboratories also did not include a balance sheet. We’ll have to wait for the company to file its annual Form 10-K with the U.S. Securities and Exchange Commission (SEC) to get this data. Last year’s Form 10-K was filed in mid-February. (Company filings can easily be accessed in the SEC’s EDGAR system.)

Abbott Laboratories raised its dividend last month by $0.04 to $0.59 per share and noted so in its earnings release. This was a 7.3% increase in the quarterly dividend payment. (Green arrows!)

Return on assets (ROA) also plays a role in the grade. A company’s return on assets is compared against its sector median. Though sector medians do not yet reflect full-year 2024 data, you could still easily calculate the return on assets for individual companies by dividing 2024 net income by average assets (assets for 2024 plus 2023 divided by two). Unfortunately, Abbott Laboratories also has yet to release its balance sheet. Many other companies include their latest balance sheet in the earnings release.

The Dividend Strength Grade considers earnings payout, total liabilities to total assets and times interest earned. The earnings payout ratio and times interest earned are compared against a company’s sector median.

Abbott Laboratories paid out $2.20 per share in dividends last year. Its adjusted full-year 2024 earnings were $4.67 per share. Dividing the dividends paid by the full-year earnings figure gives us an earnings payout ratio of 47%, which is reasonable on an absolute basis.

The times interest earned ratio is calculated by dividing earnings before interest and taxes (EBIT) by reported interest expense. Abbott Laboratories reported earnings before taxes of $7.0 billion and net interest expense of $215 million on its full-year 2024 income statement. Dividing $6.8 billion ($7.0 billion less $215 million) by $215 million results in a very strong ratio of 31.6.

We will see fully updated grades for Abbott Laboratories after all the company’s full-year 2024 financial data is released and added to our database.

Source: Abbott Laboratories.

Texas Instruments Beats But Issues Disappointing Guidance

Texas Instruments earned $1.30 per share, beating the S&P Global consensus estimate by 5.7%. Revenues declined. Cost of revenue rose because of lower production activity at company’s factories. Put another way, factory costs did not decline as quickly as production did. The $1.15 per share midpoint of the company’s first-quarter 2025 earnings guidance is below yesterday’s S&P Global consensus estimate of $1.216 per share.

This week’s two reports change the DI portfolio’s fourth-quarter 2024 earnings scoreboard to two beats and two in-line reports.

Dividend News

Texas Instruments will trade ex-dividend next Friday, January 31.

Three companies will make dividend payments next week: Quest Diagnostics Inc. (DGX) on Wednesday, January 29, followed by EOG Resources Inc. (EOG) and IDEX Corp. (IEX) on Friday.

Three companies will announce earnings next week: Quest Diagnostics and Tractor Supply Co. (TSCO) on Thursday, January 30, followed by Eastman Chemical Co. (EMN) on Friday.

No stocks declared dividends this week.