Previewing First-Quarter Earnings Season

April 11, 2025 | Markets swung on tariff news, but dividend stocks held up. See how volatility, earnings forecasts, and BlackRock’s beat are shaping Q1 2025.

This was a roller-coaster week marked by very high levels of volatility in the stock market. Wednesday’s announcement by the Trump administration about a 90-day pause on reciprocal tariffs for many countries followed big declines for stocks and problems with the bond market. The stock market quickly reversed course on Thursday and opened toward the downside this morning.

New issuances of corporate bonds slowed to a crawl, with just one offering completed between Wednesday, April 2, and Tuesday, April 8. The uncertainty over tariffs caused borrowing costs to rise. These higher costs, in turn, led corporations to postpone issuing new debt.

A significant slowdown in bond issuances is an economic problem because it means less investment in long-term projects. It also signals tighter access to credit, which has a ripple effect across the economy.

The U.S. and China are continuing to escalate trade tensions. Let’s hope that these tensions do not escalate either globally or militarily.

With this said, here are this week’s deets:

Both revenues and earnings are forecast to have risen during the first quarter of 2025.

A majority of stocks in the Dividend Investing (DI) model portfolio are also forecast to have realized earnings growth.

BlackRock Inc. (BLK) beat analysts’ estimates this morning by 11.6%.

The U.S. financial markets and the AAII office will be closed next Friday.

Previewing First-Quarter Earnings for the S&P 500

The consensus LSEG I/B/E/S earnings estimate scorecard as of the morning of April 11 calls for S&P 500 index member companies to report first-quarter earnings growth of 8.0% on a blended basis (reported and projected). This is down from the 12.2% first-quarter growth projected at the start of 2025 and the 14.3% growth projected back in October 2024.

Revenues are projected by analysts to have grown 4.1% in the first quarter. This is down from the January 1 projection of 4.9% and last October’s projection of 5.3%.

Analysts believe the health care sector will see the strongest earnings growth, with a year-over-year increase of 38.2%. Revenues are also expected to be up strongly for the sector. Technology is a strong second with 16.1% projected earnings growth. Artificial intelligence (AI) remains a key driver for many technology companies.

Energy is expected to be the weakest sector, with a 16.9% projected drop due to lower oil prices. No other sector is expected to incur a double-digit drop in earnings.

I expect to see many companies put asterisks by their full-year guidance this earnings season due to the tariffs.

First-Quarter Earnings for the DI Model Portfolio

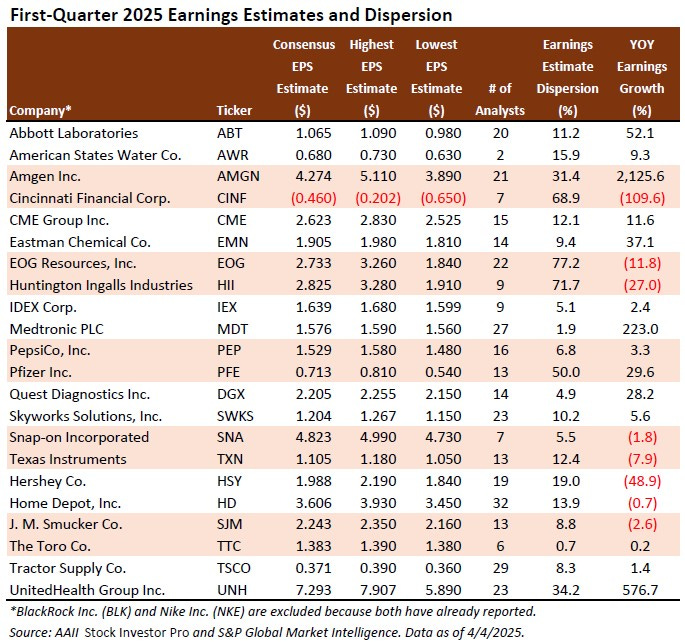

The median blended earnings growth rate for stocks in the DI model portfolio is 2.9%. Fifteen stocks are projected to report year-over-year growth in their quarterly earnings. Nine are projected to report declines.

There is a high level of dispersion in the growth rates.

Amgen Inc. (AMGN) is forecast to report year-over-year growth of 2,126%. The company incurred a mark-to-market loss on an investment last year and reported higher amortization expenses from its acquisition of assets from Horizon Therapeutics PLC. This led to Amgen reporting a $0.21 loss during its first quarter of 2024 and setting up easy year-over-year comparisons for its first quarter of 2025.

UnitedHealth Group Inc. (UNH) incurred losses during the first quarter of 2024 related to a cyberattack on its Change Healthcare segment and currency fluctuations. The company’s earnings are projected to have rebounded to $7.29 per share during the first quarter of 2025.

Cincinnati Financial Corp. (CINF) is projected to have the largest year-over-year drop. Analysts are calling for a first-quarter 2025 loss of $0.46 per share. This compares a first-quarter 2024 profit of $4.78 per share. Two months ago, Cincinnati Financial warned of $450 million to $525 million in wildfire losses.

High cocoa prices have soured earnings forecasts for Hershey Co. (HSY). Analysts expect the candy and snack company to have incurred a 49% drop in year-over-year earnings to $1.988 per share.

EOG Resources Inc. (EOG) has the largest level of dispersion in its first-quarter 2025 earnings estimates. The first-quarter consensus estimate is $2.733 per share. The highest estimate is $3.26 per share. The lowest earnings estimate is $1.84 per share.

Huntington Ingalls Industries Inc. (HII) and Cincinnati Financial also have high levels of dispersion, as shown in the table below. High levels of disagreement among analysts increase the odds of a company issuing an earnings surprise. Unfortunately, dispersion does not predict whether the surprise will be a positive or a negative one.

BlackRock’s Beat

BlackRock became the second company in the DI model portfolio to beat analysts’ expectations. Its first-quarter 2025 earnings were 11.6% above the S&P Global consensus estimate. Net inflows were positive despite the U.S. market’s downturn. On the earnings conference call, CEO Larry Fink described the markets as functioning well despite the recent volatility. He also emphasized the company’s focus on introducing more infrastructure-related investment products.

A Holiday-Shortened Week With Earnings

As noted above, the U.S. financial markets and the AAII office will be closed next Friday, April 18, in observance of Good Friday. We will resume our regular weekly commentary in two weeks.

Join me and other AAII analysts on Monday, April 14, at 7:00 p.m. Central Time, for a live webinar on recent market events. We will leave plenty of time for your questions. Register here.

Abbott Laboratories (ABT) will report on Wednesday, April 16. Both Snap-on Incorporated (SNA) and UnitedHealth Group will report on Thursday, April 17.

Wishing a happy Easter and a happy Pesach to those of you observing the respective holidays.