Replacing Skyworks Solutions With Stronger Dividend Growth, Plus February Review

March 7, 2025 | AAII’s Dividend Investing portfolio replaces Skyworks Solutions with Oshkosh Corp. after dividend concerns, reviews February performance, and highlights earnings from Toro, Home Depot

This year’s first change is being made to the Dividend Investing (DI) model portfolio. Skyworks Solutions Inc. (SWKS) is being replaced by Oshkosh Corp. (OSK). I discuss the change and review the model portfolio’s February performance.

First, here are the deets:

We believe Skyworks Solutions is at risk of not raising its dividend this summer, given the forthcoming drop in revenues.

Oshkosh brings with it a streak of 11 consecutive double-digit percentage dividend increases and the financial capacity for further growth.

The Toro Co. (TTC) beat analysts’ fiscal first-quarter 2025 earnings expectations. Tariffs were mentioned 24 times during its conference call.

The DI model portfolio outperformed its broad market benchmark for a second consecutive month in February.

Disconnecting From Skyworks Solutions

Skyworks Solutions is being removed from the DI model portfolio out of concern that its dividend will not be raised later this year. The company will no longer be the sole supplier for a component in Apple Inc.’s (AAPL) iPhones, starting this fall with the next iPhone cycle (iPhone 17). Skyworks Solutions expects its content position in the next iPhone cycle “to be down 20% to 25%.”

Apple accounted for 72% of Skyworks Solutions’ revenues in its fiscal first-quarter of 2025, which ended December 27, 2024. Roughly 85% of those revenues were related to the iPhone. This news significantly contributed to the 36.2% loss incurred by the stock since being added to the DI model portfolio in March 2023. (The ongoing weakness in technology stocks hasn’t helped Skyworks Solutions’ stock price either.)

February’s revenue warning occurred six months after Skyworks Solutions raised its dividend by just 2.9%. This was the smallest increase since the company first started paying dividends in 2014. (The next-smallest increase was 7.7% in 2017.)

Given the combination of last year’s small dividend increase and the coming hit to revenues, we believe the risks of Skyworks Solutions forgoing a dividend increase this summer are high.

Since the stock is being removed after its ex-dividend date, current shareholders will receive Skyworks Solutions’ dividend payment on March 17.

New Addition Oshkosh Should Give DI a Lift

Oshkosh designs and manufactures a wide variety of what it describes as “purpose-built vehicles and equipment.” The access segment (48% of total 2024 sales) includes lifts and telehandlers equipment to position workers and materials off the ground. The vocational segment (31% of sales) includes firefighting vehicles, airport ground support (such as vehicles that carry luggage across the tarmac), airport gate equipment and waste disposal trucks. The defense segment (20% of sales) creates specialty vehicles and mobility systems for both the U.S. Department of Defense (DoD) and approved foreign customers. This segment also produces the electric-battery-powered postal vans you may have seen in U.S. Postal Service (USPS) ads.

Oshkosh’s fourth-quarter 2024 adjusted earnings of $2.58 per share were essentially flat year over year but were 18.2% better than analysts had expected. Consolidated sales rose 6.3% to $2.62 billion.

Oshkosh expects full-year 2025 sales to decrease 1.4% to $10.6 billion relative to 2024. Adjusted earnings are projected to total $11.00 per share, down 6.7% year over year. The declines are attributable to lower sales in the access segment, particularly during the first half of 2025. The S&P Global consensus estimate calls for earnings growth to resume in 2026.

The company has consistently paid dividends since 2013. Prior to that, the dividend was paused in 2009 in response to the Great Recession.

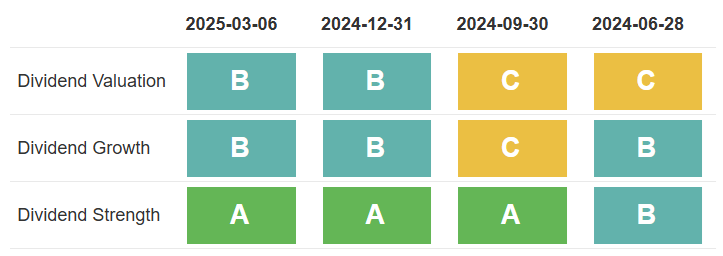

The Dividend Valuation Grade for Oshkosh is B (good value). The stock’s current yield of 2.1% is above its five-year average yield of 1.6%. Oshkosh also returns capital to shareholders via share repurchases. Last quarter, the company repurchased 494,069 shares. (The company had 65.6 million shares outstanding at the end of 2024.)

Oshkosh’s Dividend Growth Grade is B (strong). In January, the company raised its dividend by 10.9%. This was the 11th consecutive double-digit percentage dividend increase by Oshkosh. The new quarterly dividend is $0.51 per share. Cash from operations keeps the growth grade from being an A. Cash outflows increased in 2024 because of an increase in taxes due. The higher tax bill was attributable to growth in 2023 pretax income.

The Dividend Strength Grade is A (very strong). Oshkosh paid out just 17.7% of earnings as dividends last year—a low percentage. Debt is very manageable with a times interest earned ratio of 9.0.

Oshkosh was selected from the DI Ideas list for its good Dividend Grades, attractive relative yield and strong dividend growth. I will discuss Oshkosh’s selection process further next week.

Dividend Pillars for OSK

Data as of 3/6/2025.

DI Holds Up Better Than the iShares Dow Jones U.S. ETF in February

The DI model portfolio’s preference for attractively valued dividend-paying stocks helped last month. The portfolio declined 0.8%. This was better than the 1.8% drop experienced by the iShares Dow Jones U.S. ETF (IYY). Growth stocks and high beta (more volatile) stocks fared particularly poorly last month.

Fourteen stocks in the DI model portfolio rose last month. Hershey Co. (HSY) was the biggest gainer, up 15.7% in response to better-than-expected fourth-quarter 2024 earnings. The rebound more than offset its January 11.9% drop.

There was a three-way tie for second place with Amgen Inc. (AMGN), Abbott Laboratories (ABT) and Cincinnati Financial Corp. (CINF) all rising 7.9%.

Ten stocks fell. Skyworks Solutions was the worst performer, plunging 24.9% in February for the reasons explained above. IDEX Corp. (IEX) and Huntington Ingalls Industries Inc. (HII) slid 13.4% and 11.0%, respectively, in response to weaker-than-expected 2025 earnings guidance. UnitedHealth Group Inc. (UNH) fell 12.4% in response to news reports of investigations into its Medicare billing practices.

The DI model portfolio’s yield at the end of February was 2.6%. This is more than double the iShares Dow Jones U.S. ETF’s yield of 1.0%. Pfizer Inc. (PFE) remained the portfolio’s highest-yielding stock with a yield of 6.4%. IDEX Corp. continued to have the lowest yield at 1.4%.

No stocks ended the month on valuation probation. However, BlackRock Inc.’s (BLK) month-end yield of 2.1% is barely above its five-year average low of 2.0%.

The Toro Co. Beats Earnings Estimates and Addresses Tariffs

The Toro Co. earned $0.65 per share on an adjusted basis during its fiscal first-quarter 2025 ended January 31, a positive surprise of 3.2% over the S&P Global consensus estimate. Rising sales of professional golf equipment offset the weakness in the residential segment related to below-average snow accumulation. The Toro Co. maintained the $4.325 per share midpoint of its fiscal-year 2025 adjusted earnings guidance. When asked about tariffs, CEO Rick Olson said the vast majority of the company’s products are made in the U.S., while some of the residential products and irrigation products are made in Mexico. Just 20% of sales are to international customers.

The Toro Co.’s report ends the fourth-quarter 2024 earnings season for the DI model portfolio. The final earnings season scorecard is 16 positive surprises, one negative surprise and seven in-line reports.